CEO’s, CFO’s, Entrepreneurs And Business Owners, if you are struggling with cash flow, please read the message below.

Cash is king.

Those words have never been truer than they are right now.

That’s why I’m excited to share with you the number one way to boost your cash flow, profits, and valuation — even in tough times.

Just like…

When I first met William a few years ago, he said his business was absolutely brilliant.

And at first glance, he’d be right.

In the last twelve months, William's revenue had grown from $35,000,000 to $42,000,000.

His gross margin grew from 10.5% to 13.2%.

And his earnings before interest and tax, grew from $3,700,000 to $4,600,000.

William thought his business was great, as many CEO’s would.

And to tell the truth…

Because it’s easy to assume things are good as long as revenue, margins, and profits are growing.

But I know better.

Revenue is often just an illusion.

So it shocked William when I told him…

This is because businesses can manipulate their profit.

Businesses can manipulate their balance sheet…

Businesses can manipulate their valuation…

And businesses can manipulate their inventory and their fixed asset values.

But the one thing you simply can’t manipulate is your cash flow.

That’s why I say…

When I asked William the basic question, “What is your cash flow?”

Neither he nor a single person sitting around his management table was able to give me a clear and correct answer.

This was brutal.

Because here’s the thing.

You should know your cash flow, every single day.

Your net cash flow is simply defined as…

That’s it.

It’s really the most basic measure of financial success in your business.

And all you have to do is look at the movement of money in your bank accounts and bank loans.

That's why I started this letter the same way I start every consultation or presentation I do.

By saying…

Well, William didn’t have any cash in the bank.

And William’s long-term debt had grown from $9,000,000 to $10,000,000.

He had also borrowed an additional $2,200,000 short-term.

So I told William…

“Since you have no cash in the bank. And you've borrowed $1 million long-term to be added to your short-term debt. Your net cash flow shows a negative $3.2 million.”

Understandably, William had a hard time taking this in.

But I committed to working with him. I showed William how to read the chapters of his financial story.

And I taught him how by pulling on a few key levers…

Using what I call…

We could create a plan to:

This was a significant win for William.

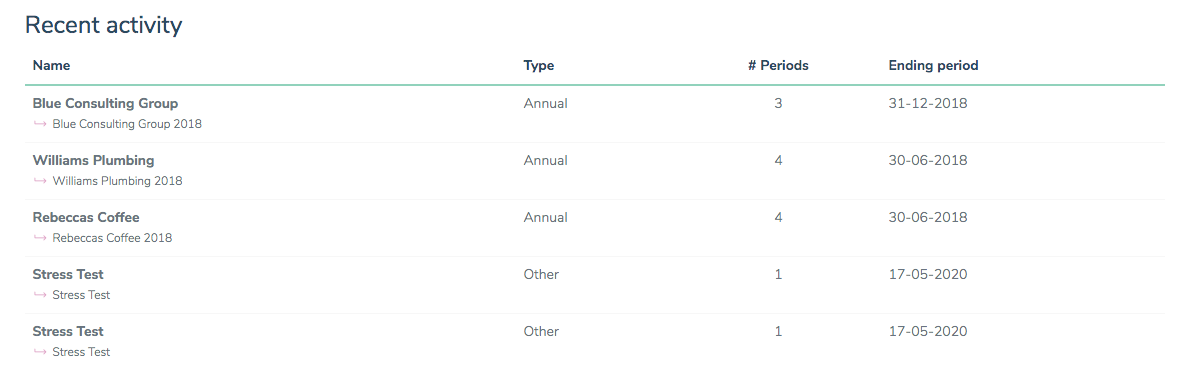

But William’s Plumbing is just one of the thousands of companies I’ve helped increase their cash flow, profits, and valuation over the years.

I’m a qualified Chartered Accountant.

And a global thought leader and speaker in financial analysis for businesses, banks, and accountants.

For the last 25 years, I’ve been the guy transforming cash flow for companies around the world.

I’m also a co-author of the international bestselling book, Scaling Up with Verne Harnish.

And a co-founder of Cash Flow Story with my partners, Joss Milner and Tim Lokot.

Cash Flow Story is a web-based financial storytelling scorecard, currently used by…

Our mission at Cash Flow Story is simple.

We exist to help you increase, measure, and easily understand your cash flow.

So you can…

Simply the easiest and most practical tool for scaling a firm's cash flow — giving the leadership team real insight into the 7 critical levers for driving valuation. There is no other simpler tool to give real visibility into the financial workings of your firm.”

That’s why I can promise you, if you’re doing at least $5MM in revenue, Managing Cash, Profit, & Value Master Business Course can help you find $1,000,000 or more…

Of extra cash flow in your business, over the next 24 – 36 months.

And if you’re not doing $5MM in annual revenues yet, Managing Cash, Profit, & Value will help you get there.

With Managing Cash, Profit, & Value, you can reach these and any of your other financial goals — Guaranteed.

In a moment, I’ll let you know how you can get a risk-free, no-obligation 3-month trial to Cash Flow Story software.

But first…

Let me explain how the program works.

As qualified Chartered Accountants, both Joss and I used to constantly struggle to explain critical financial numbers to CEO’s, business owners, and entrepreneurs.

In our consultations, we continually found the same mistake…

Unfortunately, this was giving them a distorted picture of what was really going on in their businesses.

They couldn’t understand why the bank wouldn’t loan them any more money.

Or why they were growing in sales, but not seeing more cash flow come in.

So we knew we needed to come up with a way to quickly and easily show business owners the whole story of their financial situation.

We wanted to…

And make it simple, repeatable, and fun. So everyone in the organization could understand it.

That’s why we created Cash Flow Story. To help non-financial individuals easily analyze and improve their business’s cash flow, profits, and valuation.

“I can honestly say as an engineer with no financial background — someone who barely gets past the P&L, because of my inability to understand the balance sheet — that the Cash Flow Story has made things so simple for me and so simple for the management team.”

“The Cash Flow Story Scorecard was extremely helpful in framing a consistent understanding of our financials. The 4 chapters are easy to understand and the Power of One is AWESOME!”

“Gosh it's so easy and the reporting is excellent. I just ran Blue Frog numbers through it - it took me about 10 minutes.”

We’re proud to report Cash Flow Story has helped thousands of business from all over the world…

And we’re still just getting started.

We are committed to pursuing our mission to help small businesses thrive.

And because of the current crisis, the need for cash flow is even more essential.

Senior management must constantly be monitoring cash flow to ensure the money keeps flowing through periods of growth and times of constriction.

Because…

But at the same time, growth can suck up cash.

That’s why we teach CEO’s and business owners how to balance growth with their cash flow.

So they don’t leave themselves vulnerable in the marketplace.

And right now, the most significant hedge of protection you can have for your businesses is a…

Many businesses are struggling to stay afloat right now.

The economic impact of COVID19 has toppled companies.

Many industries, and financial markets across the globe are entering a recession.

According to the American Bankruptcy Institute, there have been 560 commercial Chapter 11 filings in April 2020 alone.

CNBC reports. “That’s a 26% increase from last year.”

Some of the more notable companies to file, include:

This list isn’t even the tip of the iceberg.

There are literally hundreds of thousands of small businesses around the world…

Many entrepreneurs and executives can’t sleep at night because they are worried they won’t be able to make payroll…

Or pay back their creditors…

Or they fear getting bought out by their competition.

That’s why increasing your cash flow is so critical, especially during these uncertain times.

As the leader of your business, you are responsible for your company's financial health.

Simply put, increasing your cash flow is your key to surviving and thriving through this crisis.

That’s why you should have a quick, simple, and easy way for managing your company finances.

Because after all…

Cash flow is the number one metric for measuring your company’s performance.

And it’s the main KPI of senior management. Because understanding your Cash Flow Story is the most critical part of your business’s success.

Just like a sports team watches the scoreboard. Your organization must constantly be monitoring your cash flow.

And you can easily do that by understanding your Cash Flow Story.

Cash Flow Story gives you a simple way to quickly know your numbers. So you can make better financial decisions.

This is important for your daily operations. As well as for informing your investors, debtors, and banking partners.

I’ll often joke that businesses and banks speak different languages.

Because…

While profits and cash flow may sound similar…

They are often very different.

It’s as if you were to speak Spanish. And your bank spoke Portuguese.

You see the problem with most financial information providers is that they make things too complicated.

Financial reports are often full of industry jargon and confusing terminology.

As a result, many CEO’s have told us they feel tied you down with unnecessary details.

Financial planning meetings become a chore.

Even worse…

But the real danger lies in decisions that may be made on the basis of inaccurate information.

But this doesn’t need to happen.

We understand all you really need to know is…

Our Cash Flow Story techniques are proven to answer these questions for you.

We will show you how small changes to a few simple of areas can unlock your financial blind spots.

This will allow you to make better business and financial decisions. And it will increase your cash flow and profitability long-term.

To begin, we like to take your balance sheet and make it as simple as possible.

That way everyone in your business can understand it.

We’ll break your financials down to a single sentence:

This one sentence captures the heart of what you need to know about your corporate finances.

Your Funding consists of your debt — both long-term and short-term — and you’re your equity.

Your Operations consists of your working capital, your receivables and your inventory, or your work in progress.

Then there are your payables.

Anything on the rest of your balance sheet we call Other Capital.

That brings us to…

The story of your business is told over these four chapters.

Chapter Four, Your Funding, is the result of Chapters One, Two, and Three.

Said another way…

By using these Four Chapters, your people will be able to see and understand your numbers in real-time.

Let’s look at these Four Chapters a little closer.

Chapter One: Profit

Chapter Two: Working Capital

Chapter Three: Other Capital & Assets

Chapter Four: Funding

So by using these Four Chapters in conjunction for your business, you will have a…

Everyone on your management team will be able to read the scoreboard in a predictable and consistent way.

Your management team will be free to focus on Chapters One and Two. As these are the Chapters they most likely have control over.

Chapter Three usually cannot be influenced by management. And could potentially complicate the analysis.

So you will need to determine the appropriate level of engagement for your business.

Chapter Four is your cash flow. Again, this is…

Cash Flow Story will show you how to focus on improving Chapters One and Two in order to optimize your profit and increase your cash flow.

This will help you lead your business more profitably and effectively during these uncertain times.

That’s why I am excited to announce the new…

My co-author Joss Milner and I created the Managing Cash, Profit, & Value Master Business Course in partnership with the Growth Institute.

We wanted to do our part to help businesses manage and increase their cash flow during this crisis.

In short, we want to help you…

The Cash, Profit, & Value Master Business Course is a comprehensive, 7-module online implementation course

Each module comes with a series of short video lessons, around 5 – 20 minutes long.

Plus each week you'll join a live group coaching session to discuss implementation and dive deep into case studies.

You’ll also get the tools, resources and worksheets, you need to…

Our goal for this course is to simplify the financial aspects of your company.

So you and your team can easily understand what actions you need to take to improve your numbers immediately.

The Managing Cash, Profit, & Value Master Business Course, will help you understand:

![]() Strategies for increasing your company’s cash flow.

Strategies for increasing your company’s cash flow.

![]() How to use the Power of One to improve your profitability.

How to use the Power of One to improve your profitability.

![]() And how to raise the multiplier for your company’s valuation.

And how to raise the multiplier for your company’s valuation.

You will have the training you need to get your team aligned in…

“In less than 15 minutes the Cash Flow Story Scorecard gave us a more meaningful financial picture... The CFS Scorecard helped us understand the best areas to improve cash flow... this is a great business improvement tool.”

“We have had an overwhelmingly positive response from our clients! It has been the perfect tool to introduce our clients into our new business advisory program and then transition them to more detailed analytical tools.”

“With less than 10 minutes of work, I was showing my client their financial story on my iPad...My client loved it.”

The Managin Cash, Profit, & Value Master Business Course typically retails for $3,990

But for a limited time, because of the economic impact of COVID19…

You can…

That’s a savings of$700 dollars

Plus you’ll get the TWO amazing BONUSES I describe below…

- You’ll participate in an interactive, online certification program, spread over 3 months.

- You’ll go through a new video training every week (more than 5 hours of study material).

- You’ll go through 6 live, online workshops with Alan Miltz and Joss Milner. They are highly interactive, so there will be Q&As and discussions with other participants.

-Each company includes 2 executives, usually CEO & CFO to together learn, agree on the strategy and implement the learnings together.

- You'll join an interactive group and community space to connect with experts, peers, and coaches 24/7.

- You’ll receive an official Master Practitioner Certificate.

- You’ll get our downloadable toolkit & PDFs to keep for life.

- All the video recordings and extra materials are yours to keep for 12 months from the start of the program.

- Starting day: 17th of June

“You can get by with decent people, decent strategy, decent execution, but not a day without cash. You run out of cash — game over.” — Verne Harnish

Module 1: Welcome to Managing Cash, Profit & Value

Module 2: The Four Chapters

Module 3: Optimizing Your Return

Module 4: The Big 3 Cash Flow Measures

Module 5: Growth and Value

Module 6: Your Bank as Your Financial Partner

Module 7: Conducting Effective Board Meetings

With the Managing Cash, Profit, & Value Master Business Course, you’ll be…

And there has never been a more critical time for you to improve your cash flow decisions than now.

Even if your business hasn’t been hit as hard as others.

You will still benefit from the Cash, Profit, & Value Master Business Course…

Because having more cash flow, higher profitability and a greater valuation will serve you better when the economy does begin to turn back around.

How to tell the financial story of your company

The ins and outs of the critical numbers in your business - and which ones matter

The 7 critical levers that can make a dramatic impact on your cash flow, profit and value

The three critical cashflow numbers that matter, and when to use each

How to integrate your financial story into everyday decisions that your management team can control

How to build an effective strategy to ramp up the value of your business

How to make your bank a True partner in your business growth

“I have used Cash Flow Story for my smaller business clients right through to my larger business clients – every client has walked away with a greater understanding of their position and with a clear direction on what areas of their business they are going to work on. The program is easy to use and the reports are clear, concise and relevant – Fantastic!”

The Cash Flow Story online dashboard is a beautiful, sleek easy to your interface that allows you to quickly see your most critical numbers.

You can go to the online Learning Center. There you can access additional videos and sample reports. To help you find more money in your business.

Inside of the Cash Flow Story online software, you’ll also be able to:

“We used Cash Flow Story recently to analyse a manufacturing client's results. We interactively set targets with the client for the coming 6 months focusing on a few key KPIs. When the client returned for his next review, his sales and profit had increased above the targets set. The client credited the improvement to the targets we set as he wrote them on a post-it note and stuck it to his computer screen, hence they "were always on his mind"

We believe Cash Flow Story has the power to…

Regardless of your current cash flow situation, we want to make it better.

So along with your Master Business Course, and your free 3-month access to the Cash Flow Story online software…

You’ll also get…

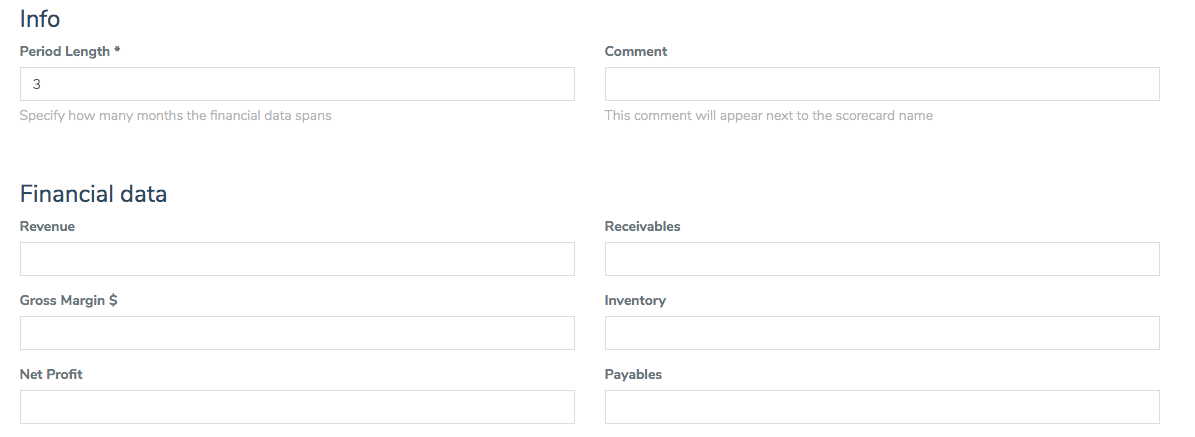

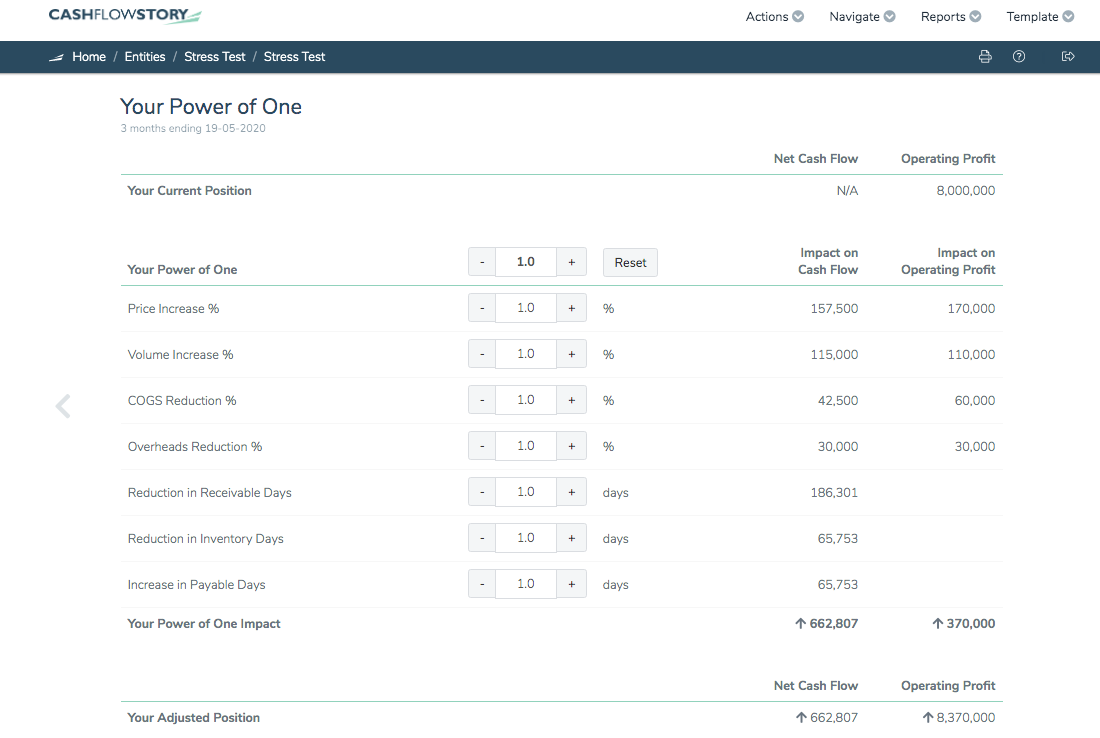

This is a special feature we have created inside of Cash Flow Story that allows you to Stress Test your business.

In this difficult time, it has never been more important to understand and manage your key financial figures. So you can preserve as much of your cash as possible.

That’s why we have introduced this quick financial Stress Test feature to help you measure your strengths or vulnerabilities during the pandemic.

To run the free financial Stress Test, all you do is input six basic numbers:

We highly recommend you input your budgeted numbers for the next three months to get an accurate read.

The Cash Flow Story software will then automatically perform a Power of One simulated Stress test on those numbers.

The results will then give you a list of insights and actions you can take immediately to improve the financial health of your organization.

The results of this Stress Test effectively represent…

With the Cash Flow Master Business course, free 3-month trial to Cash Flow Story, and the free financial Stress Test…

You get all the tools, training, and technology you need to take your business to the next level.

You could compare it to getting a free test drive in a Formula 1 race car. And I’ll personally show you how to drive it.

And you’ll get…

And because I am so confident Cash Flow Story will more than pay for itself.

I’ll give you a 30-day 100% money-back guarantee.

If you go through the 7-modules inside the Managing Cash, Profit, & Value Master Business Course…

And you don’t find the value...

I’ll instantly refund your $3,290 for the Managing Cash, Profit, & Value Master Business Course — no questions asked.

When you get the Cash, Profit, & Value Master Business Course today…

Have all found more cash flow, profitability, and valuation in their businesses by using Cash Flow Story.

And you’ll get access to the exclusive Growth Institute recorded webinar training I did called The 7 Critical Levers of Managing and Maintaining.

And you’re protected by my…

Here’s to increasing your cash flow,

Alan Miltz,

Co-Founder of Cash Flow Story

“Just completed the report for my client meeting tomorrow. It’s amazing – I love it!”

— Richard McArtney, Director, Bentleys Newcastle

What if you’re not making at least $5MM yet?

Then Cash Flow Story will help you get there.

What if you don’t have any cash in the bank?

That’s ok. Cash Flow Story will show you how to use the Power of One to pull the 7 key profit levers in your business. So you can create a consistent stream of reliable cash flow.

What if you cash flow is negative?

Remember, your cash flow also includes your change in debts. So by using the Power of One to pull the different profit levers in your business. You’ll be able to reduce working capital and create more cash flow.

Why are you making this discounted offer available now?

We want to do our part to support CEO’s, businesses owners and entrepreneurs, to scale up their companies even in this time of crisis.

Click the link below to schedule a FREE personal session with one of our Business Strategists.

Your Business Strategist will help you choose the best solution by giving you tailored advice on which priority to focus on

as well as tools you need, to grow your business with less stress and drama.

© Copyright 2024. Growth Institute / Privacy Policy / Terms of use

© Copyright 2021. Gazelles Growth Institute

Privacy Policy / Terms of use